How reserves limit the creation of money

Money is created from nothing by banks, using debt, in a money creation cycle of lending, spending, earning, and saving in which the same money gets continually re-deposited and relent time and time again. Most money created this way never leaves the banking system; it's moved around within the system using electronic and paper transfers.

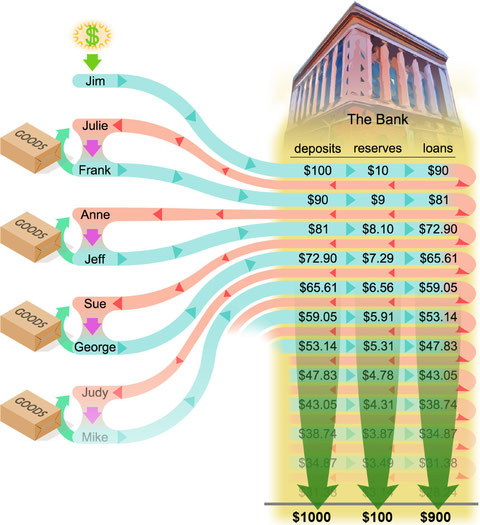

A small amount of money does leave the banking system as withdrawals of true cash (bank notes and coins.) Each cycle, as the money goes from person to person, the banks must reserve some of the money they receive from saving deposits so that they have money for withdrawals of true cash. The process looks like this:

Supposing that, considering the circumstances of the day, the banks decide to reserve 10% of the money deposited for cash withdrawals.

Start with Jim depositing $100 that he has earned into a bank account to save it; the bank now has $100 to lend to another person. The bank keeps 10% ($10) of the money in reserve and lends out the other $90 to Julie, who can now withdraw the money from the bank and spends it buying something from Frank. Frank puts the $90 that he has earned into the bank. The bank keeps 10% ($9) of the money that Frank deposited in reserve and lends the other $81 to Anne. Anne spends the $81 with Jeff, who puts it in the bank. The bank keeps 10% ($8.10) of the money that Jeff deposited in reserve and lends the other $72.90 to Sue. Sue spends the money with George, who puts it into the bank. The money will keep on going around and around like, with a little bit more of it ending up as bank reserves and a little bit less of it ending up being lent with each cycle.

Eventually, the amount available for the bank to lend out in each cycle, after the reserves have been taken out, will be reduced to near zero. When that happens the original $100 has been used to create as much money as is possible with that particular level of reserves (in this example, 10%).

Of course, no one is likely to want to borrow the obscure and very specific amounts of money used in this example; however, the banking system combines this money with money that is part of other money creation cycles, and the principle of what is shown here is maintained.

All of these savings, loans, and reserves don't usually end up with the same bank, but as the banks are all operating together, it doesn't matter; at the end of each day the banks move the money around amongst themselves to even up any differences.

As you can see in the illustration, when the money creation cycle has run its course, $1000 has been deposited in bank accounts, $100 is held in reserves and $900 of debt, as loans, has been created.

The original $100 that started the money creation cycle has been expanded to $1000, ten-times that original amount; this is because the banks decided to reserve one-tenth (10%) of the money deposited. If the banks had decided to reserve one-twentieth (5%) of the money deposited, the money creation cycle would have expanded the original $100 twenty-times to $2000, and the total debt created as loans would have been $1900. As banks make their profit from the interest they charge on loans, $1900 of loans would give then much more profit that the $900 of loans that they created with a reserve rate of 10%; this is why banks like to keep their reserve rates as low as they can.

Notice that, even though the banks expanded only the original $100 in the example to $1000 by relending that SAME MONEY many times, they get to collect interest every time they relend it as part of the total of $900 of debt (loans) created by this process, not just on the original $100! (Of course, they also have to pay some interest on the $1000 of deposits.)

Because of the need to keep reserves, the money that enables the money creation cycle (in this case, Jim's $100) will be expanded to a specific maximum amount, depending on the reserve rate applied to it; once the initial money has been expanded to this amount no more money can be expanded from it.

This page is linked from:

The consequences of keeping reserves

Agree? Disagree? Make a comment! (Comments are moderated.)

choose the future!

choose the future!

Write a comment