The money creation process

When we borrow money, we assume that it comes from the money that other people have deposited into the bank. Mostly, it doesn't; in fact, most of the money we borrow is created by the very process of us borrowing it. On the basis of a promise to repay the money in the future, the bank effectively types the balance into an account; although the money that other people have deposited is an important part of the process.

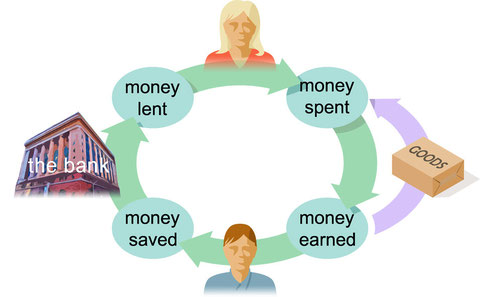

This concept of creating money by borrowing it is simple (although, unbelievable), but the actual process of creating money from debt is a little more complicated. The money creation process goes like this:

Start with a person who borrows money, takes it out of the bank and spends it. When the borrower spends the money it becomes the earnings of another person – the person that they spend it with. That person can now put the money that they have earned into a bank account to save it. The bank now has money to lend and so lends it to another person, enabling the process to start again.

Even If the person who has earned the money spends it directly rather than saving it in a bank account, it becomes the earnings of yet another person, who may spend it or save it in a bank account. Eventually nearly all of the money that is borrowed ends up back in bank accounts as savings, available to be lent out again.

This cycle of lending, spending, earning, and saving, looks like this:

Each time the banks lends-out money that is deposited as savings, it enables a new cycle of lending, spending, earning, and saving, – each time the money goes around the cycle it gets spent again as new money, and new debt is created when the money is lent-out by the bank.

The same money goes around and around the cycle, getting spent time and time again as new money — a lot more money gets spent than the money that originally started the cycle. For all the new money that is created this way, new debt of an equal value is created in the form of bank loans.

It seems that the cycle of lending, spending, earning, and saving the same money can go on endlessly without limit, creating an unlimited supply of money, and an unlimited amount of debt as it does. Of course, there are catches; although, not very big ones.

One catch for the banks is that, to keep the money creation cycle going, they must continually find enough people who are willing to borrow money and pay interest on it; these are the people who's legally enforceable promise to repay in the future underpins the value of the money created by the cycle.

The biggest catch is that any of the people who deposited money that they have earned into the bank to save it, may decide that they want to withdraw it to spend it on something; however, the bank has lent it to someone else as part of the money creation cycle! This isn't a problem if the withdrawal is by electronic and cheque transfers, but if the withdrawal is by real cash (bank notes and coins), the bank must have money available for depositors to withdraw that cash.

This page is linked from:

Spending money created from nothing

Transferring money between banks

Bank reserves for cash withdrawals

The consequences of keeping reserves

How reserves limit the creation of money

How banks minimise the need for reserves

The borrowers in the money creation cycle

The bank's risk in money creation

Agree? Disagree? Make a comment! (Comments are moderated.)

choose the future!

choose the future!

Alex Zukovski (Wednesday, 17 January 2018 13:07)

Ultimate process shown in blog, I would like to thank to give this beneficial information for us.